Global economy is in a serious crisis. Financial

markets have been battered but Indian economy has held its ground firmly and

has hailed a bright spot. Finance Minister Arun Jaitley through the union

budget 2016-17 focused efforts on rural development and fiscal discipline to

transform India with a projected corpus of Rs.19.8 lakh cr.

Budget 2016 had an enhanced focus on

agrarian concerns and the rural sector which has been badly hit by the double

whammy of twin droughts and unseasonal rains. Mr. Jaitley chose the path of

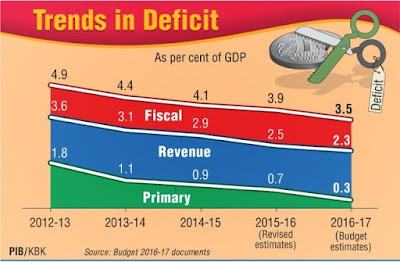

fiscal discipline by sticking to the fiscal deficit targets of 3.9 percent for

FY16 and 3.5 percent for the coming year.

Given the constraints arising from implementation

of the Seventh Pay Commission Report and One Rank One Pension, the Budget was pretty

much on expected lines with a fiscal target of 3.5 % of the GDP.

Finance Minister through “ Transform India

“ bids to have a significant impact on economy and lives of people by enhancing

expenditure in priority areas of farm and rural sector , social sector ,

infrastructure sector , employment generation and recapitalisation of banks by considering

9 pillars :

1)Agri/ Farm and welfare

2) Rural Focus

3) Social Healthcare

4) Education and Job creation

5) Investments to improve quality of Life

6) Infrastructure Focus

7) Ease of Business

8) Fiscal discipline

9) Tax Reforms

2) Rural Focus

3) Social Healthcare

4) Education and Job creation

5) Investments to improve quality of Life

6) Infrastructure Focus

7) Ease of Business

8) Fiscal discipline

9) Tax Reforms

RURAL ATTENTION:

This year’s budget is poised as a

development and growth oriented one that seeks to benefit the farmers and the

vulnerable:

·

With a vision to double farm

income in the next 5 years, higher allocation has been provided for the

flagship scheme of rural employment called MNREGA. Farm loan credit has been

increased to Rs. 9 lakh crore for the year.

·

Mr. Jaitley announced that the

government will soon embrace direct fertiliser subsidy transfer for the farmers

concerned.

·

Mr. Jaitley added that nominal

premium and highest ever compensation in case of crop loss under the Pradhan

Mantri Fasal Bima Yojana will be set up by the government under NABARD.

·

In addition, close to Rs 87,000

crore has been allocated for rural development and around Rs 2.87 lakh crore

has been proposed as grants for rural bodies in FY17. Rs. 35000 cr has been channelized

for agriculture and Rs.60,000 crore has been set aside for ground water

recharging.

·

A target of 100% rural

electrification by May 2018 and universal coverage of cooking gas in the

country was also announced. Giving a backing to AADHAR platform to ensure

benefits reach the deserving people to prevent transmission loss was announced

as well.

·

Mr. Jaitley also announced Health

protection scheme up to1 lakh per family to protect against hospitalisation

expenditure along with a dedicated long term Irrigation fund with initial

corpus of about 20,000 cr.

INFRASTRUCTURAL PUSH:

·

A total of Rs 97,000 crore

including Pradhan Mantri Gram Sadak Yojana has been earmarked for roads in

FY17. An allocation of Rs 2.19 lakh crore for road and rail sector in the Union

Budget for the next fiscal has been announced. The budget also proposed the development

160 non-functional airports across the country at a cost of Rs 50-100 crore

each.

·

Initiatives will be introduced

to reinvigorate infrastructure sector through Public-Private Partnership

(PPP).

THINGS THAT GOT COSTLIER:

·

Buying a car got costlier as

Finance Minister Arun Jaitley has announced a 1% additional tax on cars costing

above Rs.10 lakh. Small cars too have not been spared as a 1% infra cess has

been levied on them.

·

Cigarette prices will also go

up as the Finance Minister proposed to hike excise duty on tobacco (except

bidis) by 10-15 percent.

·

A 1 percent excise duty has

been levied on gold and diamond jewellery.

BANKING REFORMS:

·

RBI Act will be amended to give

statutory backing for monetary policy.

·

Bank recapitalisation figure was

scheduled as Rs 25,000 crore for FY17, and a greater push for infra spending to

boost the investment cycle was also announced.

·

Listing of general insurance

companies and bank consolidation target was also proposed.

TAX CHANGES:

·

Service Tax has been raised to

15 % from 14.5 % while the tax slabs remain unchanged. Moreover, the proposal to tax

dividends above Rs 10 lakh in the hands of the investor and increase securities

transaction tax for options trades have come as dampeners.

·

A slight relief was the absence

of the dreaded increase in tenure for long term capital gains tax.

EDUCATION/ENTREPRENEURIAL REFORMS:

·

National SC/ST hub to support

SC/ST entrepreneurs was proposed.

·

The Finance Minister also

announced that a higher education Financing Agency will be set up, with a fund

of Rs 1000 crore.

·

To boost the start-up culture,

the companies will get 100 per cent tax exemption for three

years except MAT which will apply from April 2016-2019 for

creation of jobs.

OTHER REFORMS:

·

For those with annual income

below Rs 5 lakh, the rebate under section 87A has been increased to Rs 5000

from Rs 2000. Also, the exemption limit for payment towards rent has been

raised to Rs 60,000 from Rs 24,000. But the catch here is that only those who

do not get house rent allowance and do not own a house will be eligible for the

higher limit.

·

Government will pay EPF

contribution of 8.33% for all new employees for 1st three years.

FINAL TAKE:

No comments:

Post a Comment