Abenomics

refers to the economic policies advocated by Shinzō Abe since the December 2012

general election. It

is based upon "three arrows" of fiscal stimulus, monetary easing and

structural reforms.The

Economist characterized the program as a "mix of reflation, government

spending and a growth strategy designed to jolt the economy out of suspended

animation that has gripped it for more than two decades.

NEED

FOR ABENOMICS:

- The Japanese government raised value added tax rates from 3% to 5% in 1997, which worsened recession and deflated in the economy.

- The government raised the sales tax in 1997 for the purpose of balancing its budget, and then the government revenue decreased by 4.5 trillion yen because consumption stumbled.

- The country recorded a GDP growth rate of 3 percent in 1996, but after the tax hike the economy sank into recession. The nominal GDP growth rate was below zero for most of the 5 years after the tax hike.

- During the global economic recession, Japan suffered a 0.7% loss in real GDP in 2008 followed by a severe 5.2% loss in 2009.

- Exports from Japan shrank from 746.5 billion in U.S. dollars to 545.3 billion in U.S. dollars from 2008 to 2009, a 27% reduction.

- By 2013, nominal GDP in Japan was at the same level as 1991 while the Nikkei 225 stock market index was at a third of its peak.

OLDER

ARROWS AND THEIR EFFECTS:

Abenomics

consists of monetary policy, fiscal policy, and economic growth strategies to

encourage private investment.

- Specific policies include inflation targeting at a 2% annual rate, correction of the excessive yen appreciation, setting negative interest rates, radical quantitative easing, expansion of public investment, buying operations of construction bonds by Bank of Japan (BOJ), and revision of the Bank of Japan Act.

- Fiscal spending will increase by 2% of GDP, likely raising the deficit to 11.5% of GDP for 2013.

- Two of the "three arrows" were implemented in the first weeks of Abe's government. He quickly announced a ¥10.3 trillion stimulus bill and appointed Haruhiko Kuroda to head the Bank of Japan with a mandate to generate a 2 percent target inflation rate through quantitative easing but BoJ would not loosen again its monetary policy, aimed at halting economic stagnation, soon after the increase in the sales tax in April in 2014.

- By February 2013, the Abenomics policy led to a dramatic weakening of the Japanese yen and a 22% rise in the TOPIX stock market index.

- The unemployment rate in Japan fell from 4.0% in the final quarter of 2012 to 3.7% in the first quarter of 2013, continuing a past trend.

- The yen became about 25% lower against the U.S. dollar in the second quarter of 2013 compared to the same period in 2012, with a highly loose monetary policy being followed.

- By May 2013, the stock market had risen by 55 percent, consumer spending had pushed first quarter economic growth up 3.5 percent annually, and Shinzo Abe's approval rating ticked up to 70 percent.

- The impact on wages and consumer sentiment was more muted. Only 28 percent expected to see a pay raise, and nearly 70% were considering cutting back spending following the increase in the consumption tax.

- On 4 April 2013, the BoJ announced its quantitative easing program, whereby it would buy ¥60 to ¥70 trillion of bonds a year.

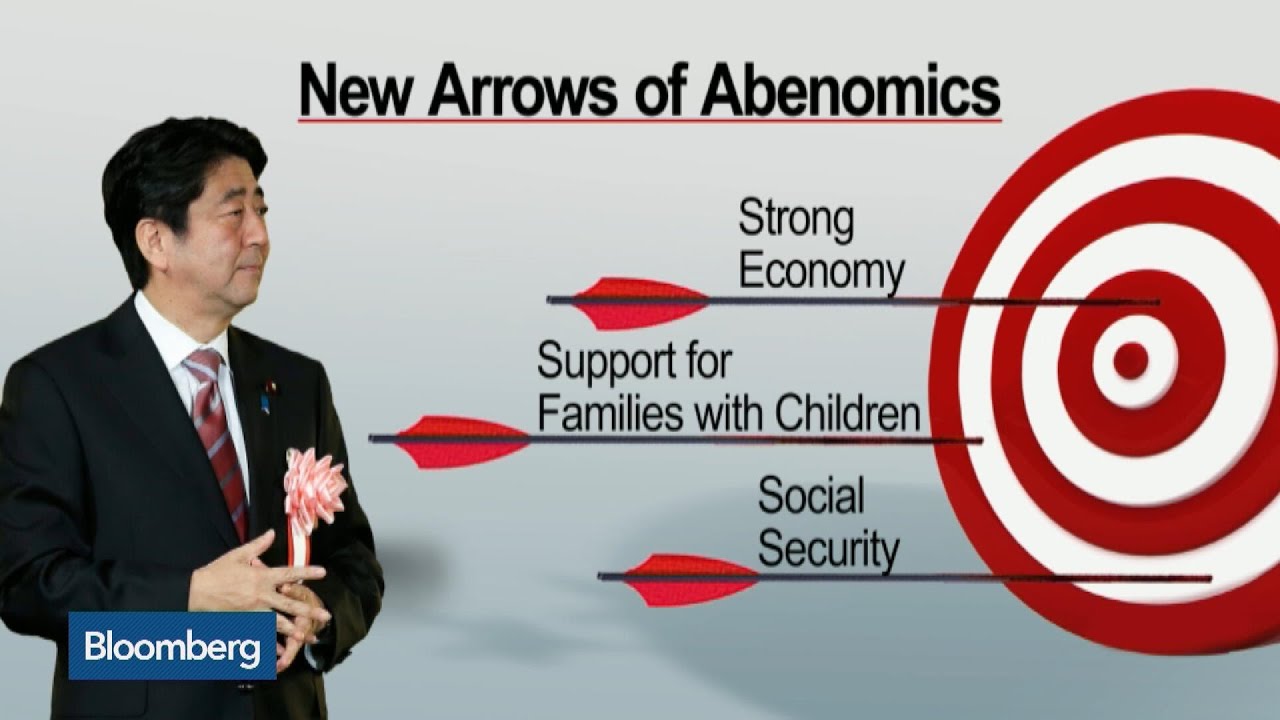

NEWER

ARROWS:

- On 31 October 2014, the BoJ announced the expansion of its bond buying program, to now buy ¥80 trillion of bonds a year.

- IMF affirmed that Japan's nominal GDP contracted by $1.8 trillion during 2012-15 while real GDP contracted at an annual rate of 6.8 percent in the second quarter of 2014, after the Value-Added Tax hike came into effect in April.

- Under a weaker Yen, Abenomics increased the cost of imports, including food, oil and other natural resources upon which Japan is highly reliant. However, the Abe government viewed this as a temporary setback, as the weaker yen would eventually increase export volumes.

- Japan also managed to maintain an overall current account surplus due to investment income from overseas.

- But the expectations were dulled by the VAT hike, and the country eventually fell back into deflation: the growth rate of GDP deflator was minus 0.3 percent in the third quarter of 2014.

- In late January 2015, BoJ governer Haruhiko Kuroda admitted that the central bank would not achieve the 2 per cent inflation target by April 2015, adding that he expected the price level to get to the target level in another 12 months.

- In February 2015, he said that the escape velocity to lift the economy out of tenacious deflation needed to be tremendous.

- The Japan Centre for Economic Research, an independent thinktank, is forecasting growth at 0.9% this year and 1.5% in 2016. -A sales tax increase planned for April 2017, to 10% from 8% now, is expected to dent growth for that year.

- Abe’s new arrows were aimed at his domestic audience and merely embellished his existing program of structural reform, which has disappointed. He promised greater financial support for families in order to raise Japan’s low birth rate, as well as extra nursing facilities for the elderly. He repeated a pledge to stop the population falling below 100 million (on current trends Japan’s population of 127 million is set to fall to 87 million by 2060).

- The new GDP target certainly underscored the government’s determination to pursue economic growth rather than focus on Japan’s huge sovereign debt, which now stands at 246% of GDP. The latest to downgrade Japan’s debt was Standard & Poor’s on September 16.

- Abe has set goals of raising Japan's fertility rate from around 1.4 to 1.8, eliminating wait lists for day care and ensuring that no one has to sacrifice employment to take care of an infirm family member.

- On the child care front, employment reform is needed to ensure that nonpermanent workers can take parental leave, said Health, Labor and Welfare Minister Yasuhisa Shiozaki. “Mini-daycare centers could help achieve a goal of providing day care availability for 500,000 children by fiscal 2017”, Shiozaki said. He also recommended expanding aid for infertility treatments.

- An even bolder step, and perhaps the only plausible way to deal with Japan’s demographic problem, would be to back higher levels of permanent immigration. At the United Nations this week, he pledged to triple aid for refugees and displaced people from Syria and Iraq, but ruled out taking any in.

- On nursing care, Shiozaki set a goal of making 400,000 additional beds available by fiscal 2020. Deregulation could enable nursing homes to operate in rented properties in urban areas where space is scare but the elderly population is surging, he said. Shiozaki also proposed allowing workers to take nursing care leave in smaller chunks.

So basically, Abenomics aimed at ending the deflation which continued for more than 15 years, focusing on massive monetary stimulus to build up self-sustain.

No comments:

Post a Comment